Scleral Lenses Insurance Coverage

Scleral lenses are a type of contact lenses that are specially designed to fit over the entire cornea and rest on the white part of the eye (sclera). They are used to treat various eye conditions, such as keratoconus, dry eye syndrome, corneal irregularities, and severe refractive errors. Scleral lenses can provide better vision, comfort, and eye health than standard contact lenses for some people

Scleral lenses have gained remarkable popularity in recent years, offering a transformative solution for individuals with complex vision needs. As these specialized lenses become increasingly indispensable for those facing ocular challenges, it is crucial to delve into the realm of insurance coverage to ensure accessibility for all who require them.

In this comprehensive article, we will explore the surge in popularity of scleral lenses, the significance of insurance coverage in this context, and the intricate details surrounding insurance for scleral lenses.

The Growing Popularity of Scleral Lenses

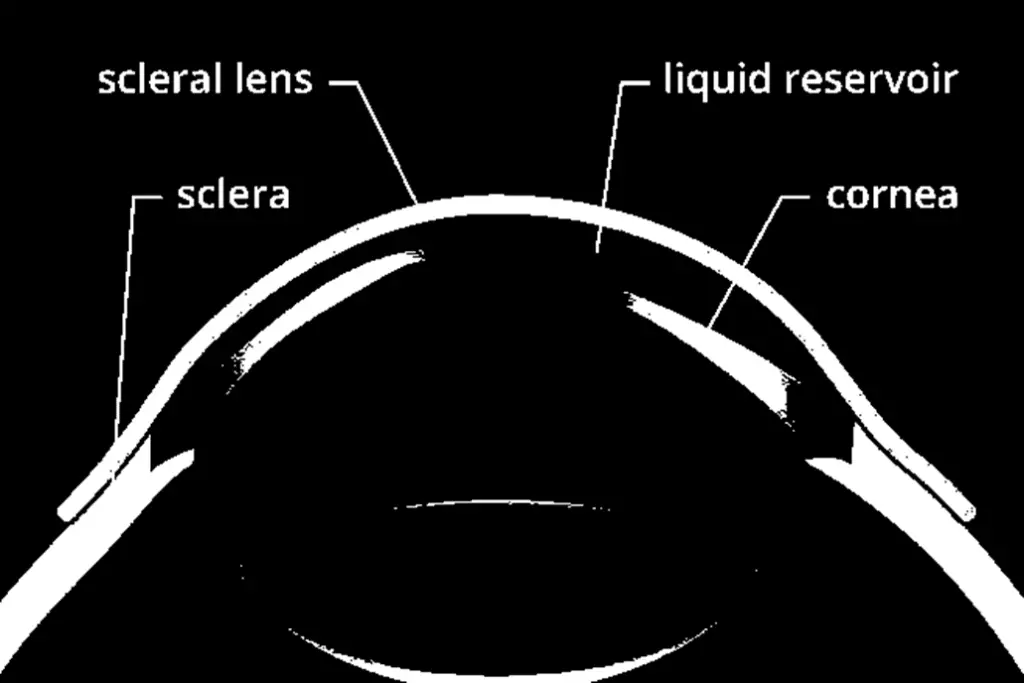

Scleral lenses represent a revolutionary advancement in the world of corrective eyewear. These lenses, notably larger in diameter than traditional contacts, rest on the sclera (the white part of the eye) rather than the cornea.

This innovative design addresses a wide range of vision problems, including astigmatism, keratoconus, and severe dry eye syndrome, to name a few. Moreover, their ability to vault over irregular corneas makes them an unparalleled solution for those with irregular corneal shapes.

The growing popularity of scleral lenses can be attributed to their efficacy in addressing these challenging conditions. Patients who have struggled with conventional glasses and regular contact lenses find a new lease on visual life with scleral lenses.

Additionally, advancements in lens materials and manufacturing have enhanced comfort, making them a more attractive choice for patients.

Importance of Insurance Coverage for Scleral Lenses

Amidst the rising demand for scleral lenses, insurance coverage plays a pivotal role in ensuring equitable access.

However, scleral lenses are also more expensive than regular contact lenses, as they require a custom fitting and frequent follow-up visits. The average cost of scleral lenses ranges from $1,000 to $4,000 per pair

Without adequate insurance support, individuals may find themselves facing financial barriers that limit their ability to benefit from this remarkable technology.

This can be a significant financial burden for many patients who need scleral lenses to improve their quality of life.

The good news is that scleral lenses may be covered by your insurance plan, depending on your diagnosis, policy, and provider. Here are some things you need to know about scleral lenses insurance coverage:

Cost of eye examination without insurance

Understanding Scleral Lenses

What Are Scleral Lenses?

Scleral lenses, as the name suggests, are designed to cover the entire sclera of the eye. Unlike traditional contacts that rest on the cornea, these lenses create a fluid-filled chamber over the eye’s surface, providing unparalleled optical correction and comfort. They are custom-fitted for each individual, ensuring a precise and secure fit.

Who Benefits from Scleral Lenses?

Scleral lenses are a game-changer for individuals with various eye conditions. Those with irregular corneas, such as keratoconus or corneal transplant recipients, often experience a dramatic improvement in vision and comfort with scleral lenses. Additionally, individuals with severe dry eye syndrome and other corneal irregularities find relief and clarity through these lenses.

Scleral Lenses vs. Regular Contact Lenses

Scleral lenses stand apart from regular contact lenses due to their unique design and applications. Regular contact lenses are typically limited in addressing complex vision issues. They may not be suitable for those with irregular corneas or severe dry eye, which scleral lenses excel in managing.

Scleral lenses are considered medically necessary contact lenses for certain eye conditions, such as keratoconus, corneal ectasia, ocular surface disease, and post-surgical complications. This means that they are not cosmetic or elective devices, but rather essential for your vision and eye health.

Scleral Lenses Insurance Coverage -Why Insurance Matters

The Cost of Scleral Lenses

Scleral lenses are a specialized and custom-made medical device. As such, they can be more expensive than off-the-shelf contact lenses. The cost includes not only the lenses themselves but also professional fitting, follow-up appointments, and maintenance solutions.

Scleral Lenses Insurance Coverage Types: Vision vs. Medical Insurance

Scleral lenses may be covered by both vision insurance and medical insurance. Vision insurance typically covers routine eye exams and prescription eyewear, such as glasses or standard contact lenses. Medical insurance covers the diagnosis and treatment of eye diseases and injuries. Scleral lenses fall under both categories, as they are prescribed to correct vision problems and to manage or prevent eye complications

Vision Insurance Coverage

Vision insurance typically covers routine eye care, prescription glasses, and contact lenses, including standard ones. However, coverage for scleral lenses may be limited or non-existent under vision insurance.

Scleral Lenses and Vision Insurance

Some vision insurance plans may provide partial coverage for scleral lenses, but it often depends on the specific plan and the medical necessity of the lenses for the individual.

Limitations and Co-Payments

Even if partial coverage is available, vision insurance plans may impose limitations and co-payments, leaving a significant portion of the cost to be borne by the patient.

Medical Insurance Coverage

Scleral Lenses as a Medical Necessity

Medical insurance is more likely to cover scleral lenses when they are deemed a medical necessity. For individuals with conditions like keratoconus or severe dry eye, scleral lenses can be essential for daily functioning.

Documenting Medical Necessity

To secure medical insurance coverage, it is crucial to document the medical necessity of scleral lenses. This typically involves detailed reports from eye care professionals outlining the patient’s condition and the recommended treatment.

Common Medical Insurance Providers

Many medical insurance providers offer coverage for scleral lenses, but the extent of coverage varies. Notable providers such as Blue Cross Blue Shield, Aetna, and UnitedHealthcare often include scleral lenses in their coverage options.

Navigating Scleral Lenses Insurance Insurance Providers

The amount of coverage for scleral lenses varies depending on your insurance plan and provider. Some plans may cover the entire cost of scleral lenses, while others may only cover a portion of it. Some plans may have deductibles, copays, coinsurance, or annual limits that apply to scleral lenses. Some plans may require prior authorization or documentation from your eye doctor to prove the medical necessity of scleral lenses

To find out if your insurance plan covers scleral lenses and how much it covers, you should contact your insurance company directly and ask them about your benefits and eligibility. You should also check with your eye doctor about their billing policies and procedures for scleral lenses. Some eye doctors may accept direct payment from your insurance company, while others may require you to pay upfront and then submit a claim for reimbursement

Tips for Dealing with Insurance Companies

Navigating insurance companies can be a daunting task. Here are some valuable tips to help you through the process:

- Understand Your Policy: Familiarize yourself with the details of your insurance policy, including coverage limits, co-payments, and deductibles.

- Communication: Maintain clear and open communication with your insurance provider. Ask questions and seek clarification when needed.

- Documentation: Keep meticulous records of all interactions with your insurance company, including names of representatives, dates, and details of conversations.

- Appeal Process: Be aware of the appeal process in case your initial claim is denied. Understand the steps and requirements for appeals.

What to Ask Your Insurance Provider

When inquiring about scleral lens coverage, consider asking these key questions:

- Is coverage available for scleral lenses under my plan?

- What documentation is required to establish medical necessity?

- Are there any restrictions on the choice of eye care professionals or lens providers?

- What is the process for filing a claim or an appeal?

- Are there any waiting periods or pre-authorization requirements?

Common Coverage Challenges

Patients often encounter challenges when seeking insurance coverage for scleral lenses. These challenges may include:

- Denial of Claims: Insurance providers may initially deny claims, requiring patients to go through the appeal process.

- Inadequate Documentation: Insufficient or unclear documentation from eye care professionals can lead to claim denials.

- Out-of-Network Providers: Using out-of-network eye care professionals or lens providers may result in reduced coverage.

Out-of-Pocket Costs

Copayments and Deductibles

Out-of-pocket costs for scleral lenses can include copayments and deductibles. Copayments are fixed amounts you pay for each covered service, while deductibles represent the amount you must pay before your insurance coverage kicks in.

If your insurance plan does not cover scleral lenses or only covers a small amount of it, you may still have other options to afford them. You can ask your eye doctor about payment plans, discounts, or financing options that they may offer. You can also look into alternative sources of funding, such as health savings accounts (HSAs), flexible spending accounts (FSAs), health reimbursement arrangements (HRAs), or charitable organizations that provide assistance for people with vision problems

HSA and FSA Options

Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) can be used to pay for scleral lenses and related expenses with pre-tax dollars, providing potential cost savings.

Financing Scleral Lenses

Some lens providers offer financing options to help patients manage the cost of scleral lenses over time. These financing plans may come with competitive interest rates and flexible repayment terms.

In-Network vs. Out-of-Network Providers

Advantages of In-Network Providers

Using in-network eye care professionals and lens providers can be advantageous in terms of insurance coverage. In-network providers have established agreements with insurance companies, making the claims process smoother and potentially reducing out-of-pocket costs.

Considerations for Out-of-Network Providers

While in-network providers may be more convenient, some patients may prefer out-of-network professionals due to their expertise in fitting scleral lenses. If you opt for an out-of-network provider, be prepared for potential higher costs and additional paperwork.

Finding an In-Network Provider

To find in-network eye care professionals and lens providers, consult your insurance company’s provider directory or website. They can provide a list of approved practitioners and facilities in your area.

Appealing Insurance Denials

Understanding Denial Reasons

If your insurance claim for scleral lenses is denied, it’s essential to understand the reasons behind the denial. Common reasons may include lack of medical necessity documentation or coding errors.

Steps for Appealing a Denial

- Review the Denial Letter: Carefully review the denial letter from your insurance company to understand the specific reasons for the denial.

- Gather Documentation: Collect all necessary medical records, prescriptions, and supporting documents that demonstrate the medical necessity of scleral lenses.

- Contact Your Provider: Consult your eye care professional to ensure that the documentation is accurate and complete.

- Submit an Appeal: Follow your insurance company’s appeal process, providing all required documentation and a well-written appeal letter.

Success Stories

Many individuals have successfully navigated the challenges of insurance coverage for scleral lenses. These success stories serve as testaments to the importance of persistence and advocacy in securing the necessary coverage for improved vision and quality of life.

Alternative Funding Options

In cases where insurance coverage remains elusive or insufficient, several alternative funding options can help make scleral lenses more accessible.

Non-Profit Organizations

Several non-profit organizations and foundations provide financial assistance to individuals in need of specialized eyewear. These organizations often focus on specific eye conditions and may offer grants or subsidies.

Patient Assistance Programs

Some lens manufacturers offer patient assistance programs to help offset the cost of scleral lenses. These programs can provide discounts or financial aid based on the patient’s financial situation.

Local Charities and Grants

Local charitable organizations and community grants may also offer financial support for individuals facing vision challenges. These resources can vary by location, so it’s worth researching options in your area.

Scleral Lenses and Pre-Existing Conditions

Insurance Implications for Pre-Existing Eye Conditions

If you have a pre-existing eye condition that requires scleral lenses, it’s important to understand how your condition may impact insurance coverage. Pre-existing conditions can influence the terms and approval process for coverage.

Special Considerations for Scleral Lenses

Given the specialized nature of scleral lenses and their role in addressing pre-existing eye conditions, insurance providers may take a closer look at medical necessity and documentation in these cases.

Success Stories of Pre-Existing Condition Coverage

Despite the complexities associated with pre-existing eye conditions, many individuals have successfully obtained insurance coverage for scleral lenses. Their experiences highlight the importance of persistence and advocacy in securing the necessary support.

Tips for Maximizing Insurance Benefits

To optimize your chances of securing insurance coverage for scleral lenses, consider these strategies:

- Regular Documentation and Records: Maintain up-to-date and comprehensive medical records related to your eye condition and treatment.

- Annual Checkups and Updates: Attend regular eye checkups and follow-up appointments to ensure that your medical records reflect the ongoing necessity of scleral lenses.

- Understanding Policy Changes: Stay informed about changes in your insurance policy, including coverage limits and any alterations in the list of approved providers.

Conclusion

In conclusion, the accessibility of scleral lenses through insurance coverage is of paramount importance. As these innovative lenses continue to transform the lives of individuals with complex vision needs, advocating for comprehensive insurance support becomes a crucial endeavor.

Follow us in Facebook

Discover more from An Eye Care Blog

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.